Its less expensive to buy long term care insurance the younger you are so dont wait to apply for a policy until you are on the cusp of needing long term care. This article was originally published on may 6 2015 and was updated on april 8 2018.

Long Term Care Alternative The Financial Retirement Group

People often need long term care when they have a serious ongoing health condition or disability.

What is long term care insurance and who needs it. Buying long term care insurance is a good idea for people who are in good health but want to plan ahead for future costs that are not typically covered by traditional health insurance. The need for long term care can arise suddenly such as after a heart attack or stroke. Long term care is the unsolved problem for so many people says christine benz director of personal finance at morningstar an investment research firm in chicago.

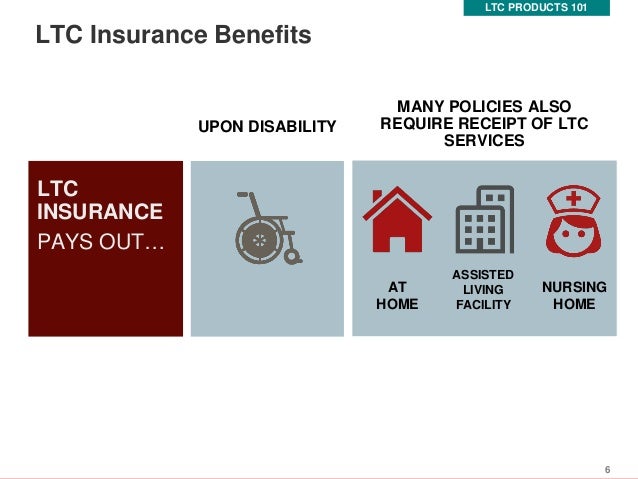

Unlike traditional health insurance long term care insurance is designed to cover long term services and supports including personal and custodial care in a variety of settings such as your home a community organization or other facility. Who needs long term care long term care is typically needed by the elderly but it is also required by anyone with a debilitating illness or injury who needs assistance to perform everyday. Long term care insurance covers care generally not covered by health insurance medicare or medicaid.

Long term care insurance is designed to help you cover the costs of a nursing home or other skilled care as. Assisted living runs 45000 annually and home health aides charge 135 per day. Types of long term care insurance traditional long term care insurance.

According to the us. The median cost of a semiprivate nursing home room nationwide is 85775 per year according to genworths 2017 cost of care survey. Long term care insurance ltc or ltci is an insurance product sold in the united states united kingdom and canada that helps pay for the costs associated with long term care.

Department of health and human services hhs about 70 of people turning age 65 will need long term care services at some point in their lives. Long term care also includes community services such as meals adult day care and transportation services. Long term care insurance premiums are notoriously high.

Heres what you need to know about ltc insurance today. You can expect to pay several thousand dollars a year in premiums and the rates rise steeply if you wait until youre 65 or older to buy a. These services may be provided free or for a fee.

2 and contrary to what many people believe medicare and private health insurance programs do not pay for the majority of long term care services that most people need.

What Is Long Term Care Insurance And Should I Get It Womenwhomoney

Understanding Long Term Care Insurance Vs Life Care Plans

Long Term Care Insurance Basic Pricing Concepts

What Does Long Term Care Insurance Cover Dailycaring

0 Comments