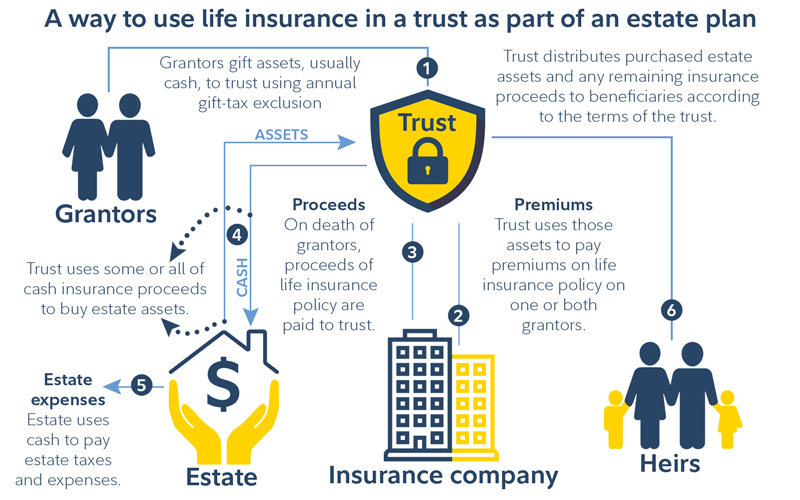

However any interest you receive is taxable and you should report it as interest received. Life insurance will be included in your estate unless it is owned outside the estate using trusts or other owners.

Can Life Insurance Help Your Estate Plan Fidelity Investments

Code 101 certain death benefits a proceeds of life insurance contracts payable by reason of death 1 general rule.

How to ensure your life insurance is not taxed upon your death. Life insurance is typically not taxed upon your death for income tax purposes. Generally a life insurance payout to your dependents wont be taxed and can be paid as either a lump sum or income stream. Make sure your life insurance is not taxed at your death march 16th 2016 although your life insurance policy may pass to your heirs income tax free it can affect your estate tax.

Life insurance distributions following the death of someone else are not taxed. The main reason to buy life insurance is to provide a payout to your beneficiaries after your death. For those estates that will owe taxes whether life insurance proceeds are included as part of the taxable estate depends on the ownership of the policy at the time of the insureds death.

However the tax free status of death benefits can be affected when purchased via a superannuation fund andor is paid out to non dependants. Now while the premiums on your life insurance are certainly not free generally the death benefit on your life insurance is not taxable to your beneficiary. Life insurance offers desirable tax advantages though it is not exactly tax free.

1 any loans from the policys cash value will reduce the policys cash value and death benefit if the borrowed funds plus interest are not repaid by the time of your death. Life insurance proceeds arent taxable most of the time. Beneficiaries will not have to.

Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. If a beneficiary receives a distribution from your life insurance plan upon your death he does not have to pay income tax on it. Withdrawing too much from a universal life policy.

See topic 403 for more information about interest. Here are ways your life insurance benefits could be taxed. If your question is about estate tax it is not as simple.

Further if your life insurance policy is classified as a modified endowment contract mec distributions including loans may be taxed less favorably than non mec.

What Is Guaranteed Universal Life Insurance And How Does It Work

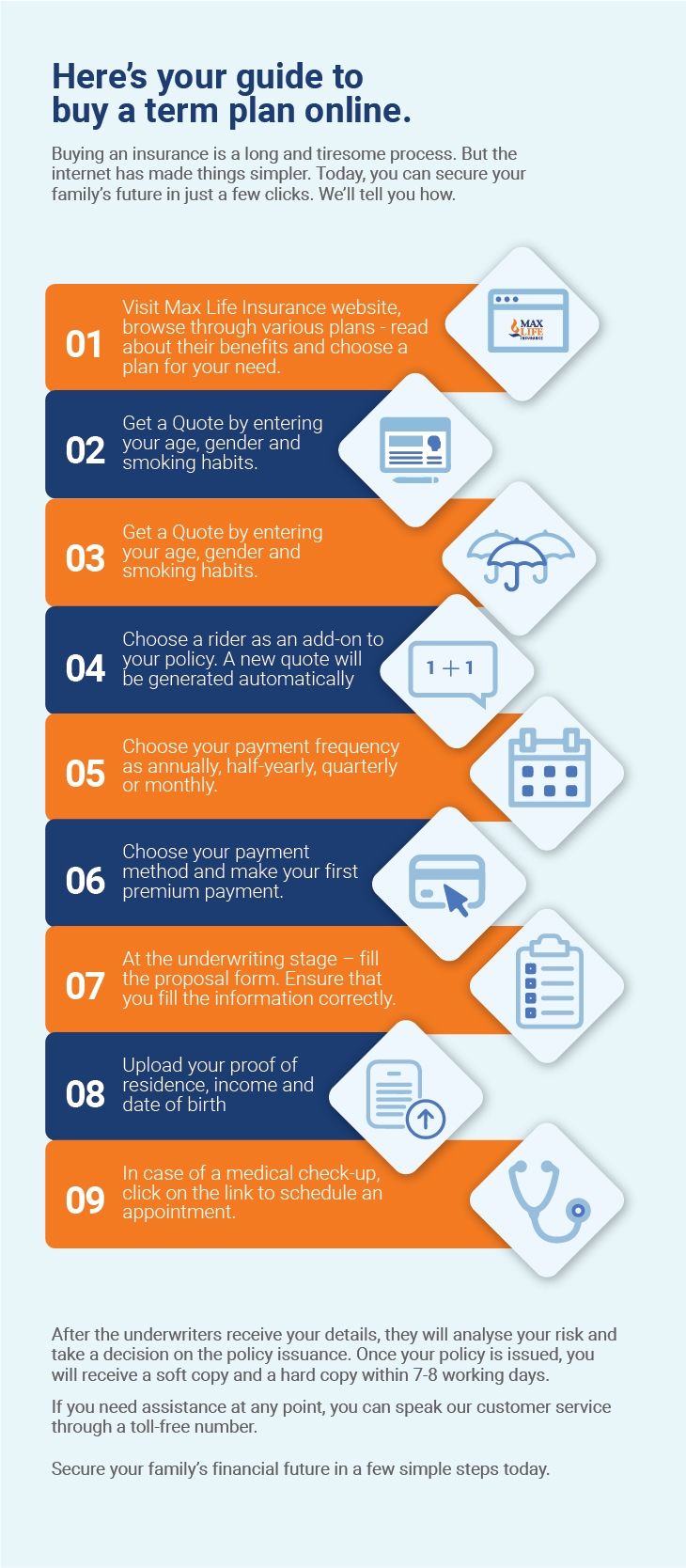

Term Plan Max Life Online Term Plan

Life Insurance And Protection Advice In Longton Preston Ormskirk

Icici Prudential Life Insurance Best Life Insurance From Icici

0 Comments