We want the payout to the spouse to be as quick and painless as possible. You can also set up a trust for the children and designate someone as trustee to manage and spend the money for the childs benefit.

Can My Sister Make Me Share Life Insurance Proceeds If I Am The

Always put down the full name of each person you want to be a beneficiary.

Who can i name as the beneficiary of my life insurance policy. Quotacy can help you set up your term life insurance policy to benefit your loved ones a business or charity. When you are applying for coverage you can name a single person multiple people a trustee a charity or your estate. You can name a child as a beneficiary but you should be aware that life insurance companies cannot pay out a policy to a minor.

5 beneficiary mistakes people can make on their life insurance policy and retirement plans. Naming a life insurance beneficiary should be an easy and uncomplicated process. You can name one beneficiary or multiple beneficiaries on your life insurance policy.

For this reason a married person will typically name their spouse as the direct beneficiary of the life insurance policy and name the trust as the successor beneficiary. Hello you can select your spouse parent children or a trust as the beneficiary of your life insurance policy. If you are not married you can name your parents and if you wish to change the beneficiary after you get married you can always do that even when the policy is in force.

A beneficiary is a person or entity that you name and designate to receive a portion or the entire death benefit paid out from your life insurance policy. Naming a beneficiary is a crucial part of the life insurance process. When a minor is a primary beneficiary most states utilize the uniform transfer to minors act which allows the proceeds from a life insurance benefit to transfer to a childs named custodian.

Choosing the beneficiary for your life insurance policy requires careful thought and consideration. Your personal situation and goals for the money will dictate the most appropriate recipient of your policys proceeds. A beneficiary is an individual institution trustee or estate which receives or may become eligible to receive benefits under a will insurance policy retirement plan trust annuity or other contract.

While it can be straightforward in many cases there are a number of potential legal financial and tax related problems that can occur if you dont name your beneficiaries properly. You would name the trust as the beneficiary of the life insurance policy. If you fail to name a beneficiary and you die the life insurance policy typically becomes part of your estate and is subject to probate.

Structuring your beneficiaries properly will ensure that your death benefits go to the individuals you intend.

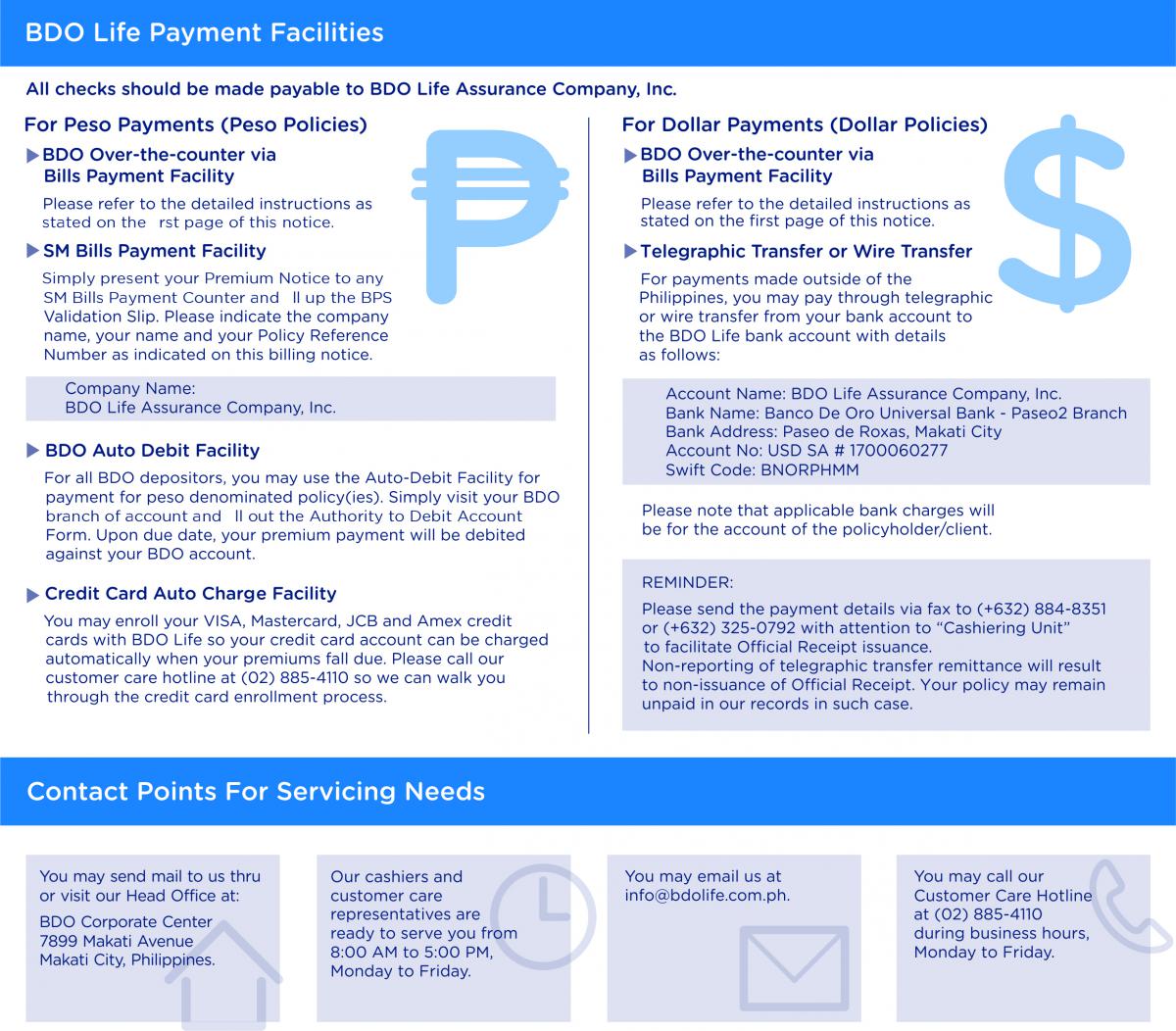

Faqs Bdo Unibank Inc

How To Tell If Your Life Insurance Beneficiary Is Trying To Kill You

Collecting On A Life Insurance Policy

6 Ways To Designate Minor Children As Life Insurance Beneficiaries

0 Comments