Are non life insurance policies really worth buying. Is it worth to take term insurance with rider.

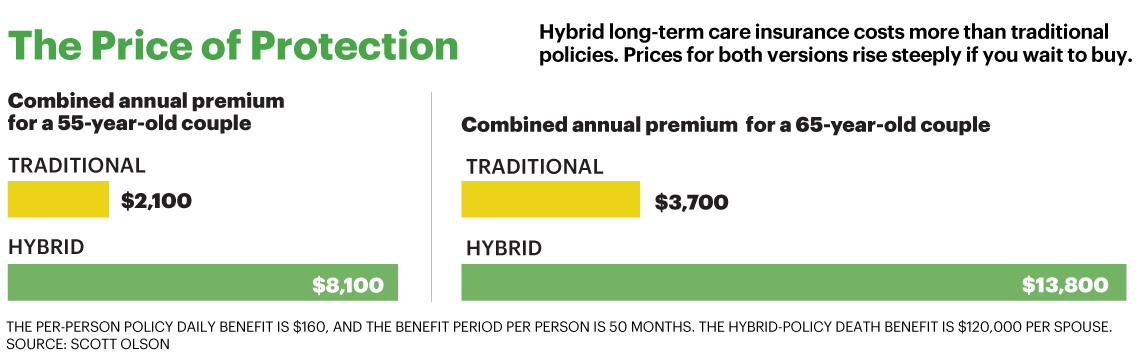

5 Facts You Should Know About Long Term Care Insurance

And unlike say renovating your kitchen purchasing term life insurance is an affordable way to provide a financial safety net for your loved ones long into the future if you were to die.

:brightness(10):contrast(5):no_upscale()/work-life-ins-policy-56a634e03df78cf7728bd5b3.jpg)

Is it really worth to buy a term life insurance. So youre thinking about buying life insurance but do you really need it. It is advisable to take because premium is very low in compare to lic policies. Policy is like life insurance term policy but it will become payable only in case of death or disability due to accident.

So is life insurance worth it. Life insurance is not really an. But if you buy term life when youre young and healthy the monthly premium can cost as little as 30 40.

Why it is good to take term insurance with riders. Getting buy term life insurance crossed off your list is worth it for peace of mind. Is it worth it and when do you need it.

6 myths about buying life insurance. Your death is the reason you buy the policy. Jay macdonald at.

Is it really worth to buy a term life insurance. If you died because of an accident and you have taken accidental death rider then you are eligible to avail the benefit of riders as well as the basic sum assured of the. When life insurance isnt worth it.

Term life insurance is a lot like the life insurance part of whole life insurance except that it ends after a specified number of years. Learn more about why you should consider a term life policy and who its right for. This is one of the common selling points for whole life or universal life rather than term life insurance.

And a standard term life insurance plan has zero. So your example of a 30000 whole life policy with a 20 premium compared to a 30000 term life policy with that same 20 premium is not a valid comparison. By zina kumok december 6.

Is it really worth to buy a term life insurance. But if youre looking for a quick net worth boost at deaths door or a last minute cash windfall for your heirs dont count on a. Realistically the older you get the more any insurance is going to cost.

First a term life insurance policy will cost much less than a whole life insurance policy with the same death benefit often around 12 times less. Thats another reason why term is more highly recommended. Because term is so much cheaper than whole life insurance you can buy a lot more coverage meaning a larger death benefit for the same amount of money.

When buying a policy you can sometimes forego the medical exam but doing so will often get you higher rates. Thats why term life insurance is worth it for a majority of shoppers. You only really need life insurance if someone is.

:brightness(10):contrast(5):no_upscale()/work-life-ins-policy-56a634e03df78cf7728bd5b3.jpg)

Should I Get My Life Insurance Through Work

Is Term Life Insurance Worth It

Is It Worth Buying Gap Insurance Buy Can Long Term Care Insurance

What Is Life Insurance And How Does It Work Daveramsey Com

0 Comments