How much is enough. Without liability insurance if you lose a lawsuit you will have to pay the judgment yourself.

2014 Product Liability Insurance Certificate Zhejiang Renhe

The problem and challenge with liability policy limits is that there istheoreticallyno upper bound on the amount for which a jury award can sock you.

How to decide on the amount for product liability insurance. How to calculate business liability insurance needs. How to calculate business liability insurance needs. Secured loans personal loans debt travel money legal services business finance transfer money all our money products.

When readers buy products and services discussed on our site we often earn affiliate commissions that support our work. Product liability insurance can protect manufacturers wholesalers and retailers from expensive lawsuits. Personal liability insurance or umbrella insurance is insurance that helps to keep your assets intact if you are sued.

General product and professional. Here is a look at the costs and coverage options. How to choose personal liability insurance.

Another factor to take into account when youre considering how much public liability. While there is no mystical formula to determine how much liability coverage is. Liability insurance also called third party insurance is a part of the general insurance system of risk financing to protect the purchaser the insured from the risks of liabilities imposed by lawsuits and similar claims.

Heres how to determine the right amount of general liability insurance for your business. The amount of public liability insurance you need will depend on the type of work that you do and the risks your business faces. Once upon a time million dollar awards were unusual.

Know your business you cant predict every bump in the road ahead but you can assess how much general liability insurance you might need. If someone sues you for everything you have this the amount which currently isnt. The amount of liability insurance coverage you need depends on the type of business you are in and the risks associated with it.

Co authored by wikihow staff. Identify if you create or sell products. Subtract the amount that your insurance would currently cover you for from your net worth.

Product liability insurance protects a company against claims or suits arising from the companys products whether they were made by the company or sold by them. For example a large roofing contractor will need more coverage than a home based consultant. This form of insurance covers a manufacturers or sellers liability for bodily injury or property damage sustained by a third party due to a products defect or malfunction.

A business faces many risks. There are three types of liability insurance. Product liability insurance exists to cover any injuries caused by products you manufacture.

Products Liability Insurance Hayes Brokers

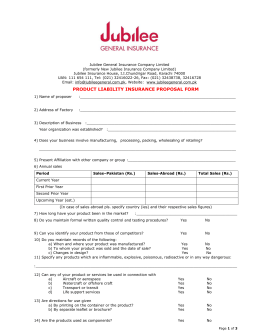

Proposal For Public And Products Liability Insurance

Property And Liability Insurance Underwriters France 2016 Statistic

Public Products Liability Lnsurance Faqs

0 Comments