The contestability period is a period after the life insurance policy is purchased during which if the insured person dies the insurance company has a right to contest the claim for a policy pay out. The clause applies only when the policy has been in effect for a specified period of time.

:max_bytes(150000):strip_icc()/179242090-5bfc392646e0fb00265fa90b.jpg)

Incontestability Clause

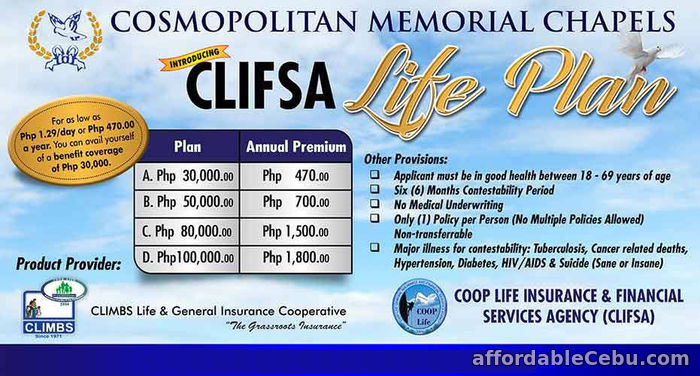

Contestability period on pre existing conditions shall be applied 6.

Contestability period insurance philippines. This time period the contestability period is usually two or three years. After the contestability period ends life insurance coverage is usually considered incontestable. Contestability clause shall be waived.

It begins as soon as a policy goes into effect. Insureds alleged concealment in his pension plan application of his true state of health and its effect on the life insurance portion of that plan in case of death. Death by suicide only becomes a valid claim during this period.

Police report if claim is accident related. Contestable claim means that the death occurs in less than two 2 years from the date of effectivity of the policy. Year contestability period shall start again on the date of approval of your.

What is the contestability period. Incontestable means that axa philippines cannot revoke your contract after two 2 years provided that your policy is still in force. This means your beneficiary will usually receive the coverage amount as long as the coverage was in force.

The period is two years in most states and one year in others. Certificate of insurance to surrender fortune care id 6. But unless you lie on your life insurance application the contestability period is nothing to worry about.

The facts and the case. Other documents to be required when necessary b. By leslie freeland october 10 2016 the contestability period is the period of time an insurance company has to investigate and approve or deny your claim.

The life insurance contestability period is a short window in which insurance companies can investigate and deny claims. Most states maintain statutes that require an incontestability clause in life and health insurance contracts. The life insurance contestability period explained.

Velasco jr j chairperson versus. Some states allow insurance companies to include a provision stating that a one or two year contestability period must be completed within the lifetime of the insured.

Insurance Claseek Philippines

Low Premium Life Plan Memorial Insurance St Peter Loyola Eternal For

Majar Insurance Agency And Business Ventures Inc Villa Sol Baybay

What Is The Life Insurance Contestability Period

0 Comments