Looking for the average cost of life insurance for your age or curious how much insurance costs. Term life insurance is simple to buy and easy to afford making it the ideal way for young families to get the financial security they need.

Life Insurance For 70 To 75 Years Old You Need To See This Now

The answer may surprise you for the majority of 50 59 year olds a 10 20 year term life insurance policy will suit their needs perfectly.

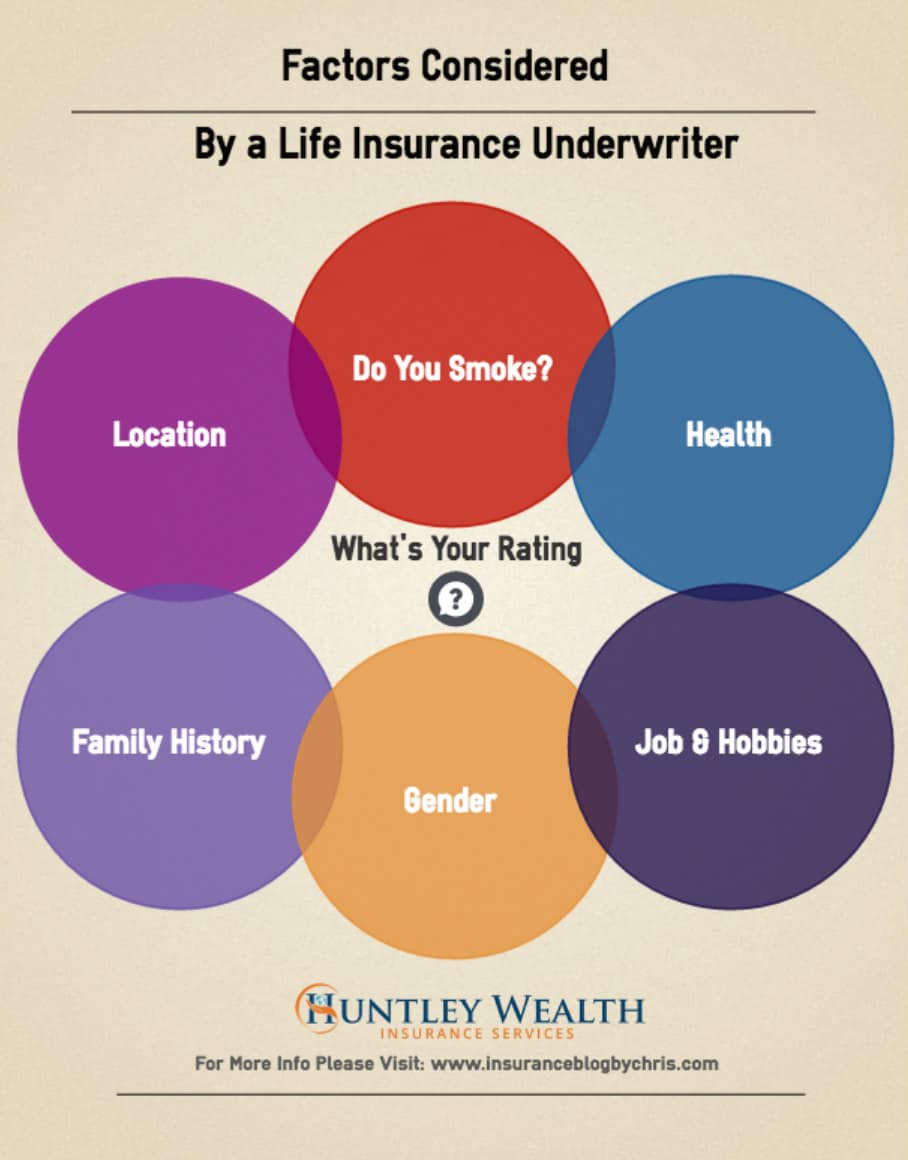

At what age will you cancel your term life insurance. Protect the ones you love for life term life insurance with a guaranteed income tax free death benefit can make it simple to protect your loved ones for a specific period of time. Insurance companies use family history to evaluate your risk. Once you reach your eighties many of your priorities change including financial priorities such as your life insurance coverage and preparation for your final expenses.

We have sample life insurance rates by age for term life universal life and whole life. Getting a life insurance policy when you are over the age of 80 is much different than when you are in your fifties sixties and seventies. You may have your own reasons for surrendering your life insurance policythe reasons must be significant enough since surrendering a policy would mean that you lose all the benefits that had prompted you to go for it in the first place.

What youll see after clicking show my rate is your ballpark estimate for your term life insurance quotes. One metric used is the age at which a family member has passed away from a disease. Term or whole life in your 50s.

Protect your familysimply and affordably 1. When you begin the tedious task of searching for an inexpensive term life insurance plan youre bound to become frustrated with what seems like the never ending process of information gathering. Perhaps youve spoken to agents who only want to quote whole life.

At termlife2go our goal is to find you the best life insurance policy at the lowest price available. If you are set on purchasing a term life insurance policy we would recommend that you take a look at 100000 in coverage. Here you can see that a term life insurance policy that lasts 15 years and covers your family with 350000 worth of life insurance will range in cost from approximately 11 to 31 per month based on standard rates.

Robert most life insurance companies arent going to be interested in offering a term life insurance policy for just 25000 in coverage.

Term Insurance Compare Online Term Plans Policy

What S The Cost Of Life Insurance 6 Tips That Will Save You Thousands

Life Insurance Compare Best Life Insurance Plans Online In India 2019

Group Term Life Insurance The Aia Trust Where Smart Architects

0 Comments