Senior citizens saving scheme and post office time deposit 5 years if any of the aforesaid investments subscriptions etc is terminated sold etc before the. Is there any tax benefit on the premium i pay for my insurance policy.

Divorce And The Benefits Of Life Insurance Divorce Dimensions Inc

This means that the money can accumulate over time without the policy holder having to paying tax on the gains while they remain in the account.

Are there any tax or savings benefits from life insurance. First the funds that are in the policys cash value component are allowed to grow tax deferred. The owner may exchange a life insurance policy for an annuity free of income taxes. Secure your familys future with the benefit of life insurance cover savings with guarantees.

There will be an additional charge of 050 pa. And 010 pa towards the investment guarantees for easy retirement balanced fund and easy retirement secure fund respectively which. Deduction is available under section 80c of income tax act 1961 for the premium paid on life insurance policies with a maximum annual ceiling of rs.

There are multiple modes for saving tax but life insurance is one of the most effective tax planning instruments. If the premium paid is not more than 10 of insured value than it is allowed as deduction from taxable income. If it exceeds 10 as written above than only 10 is allowable.

Proceeds of key man insurance is taxable. For more information contact a ca or tax consultant. Tax benefits due to life insurance policy health insurance policy and expenditure on medical treatment.

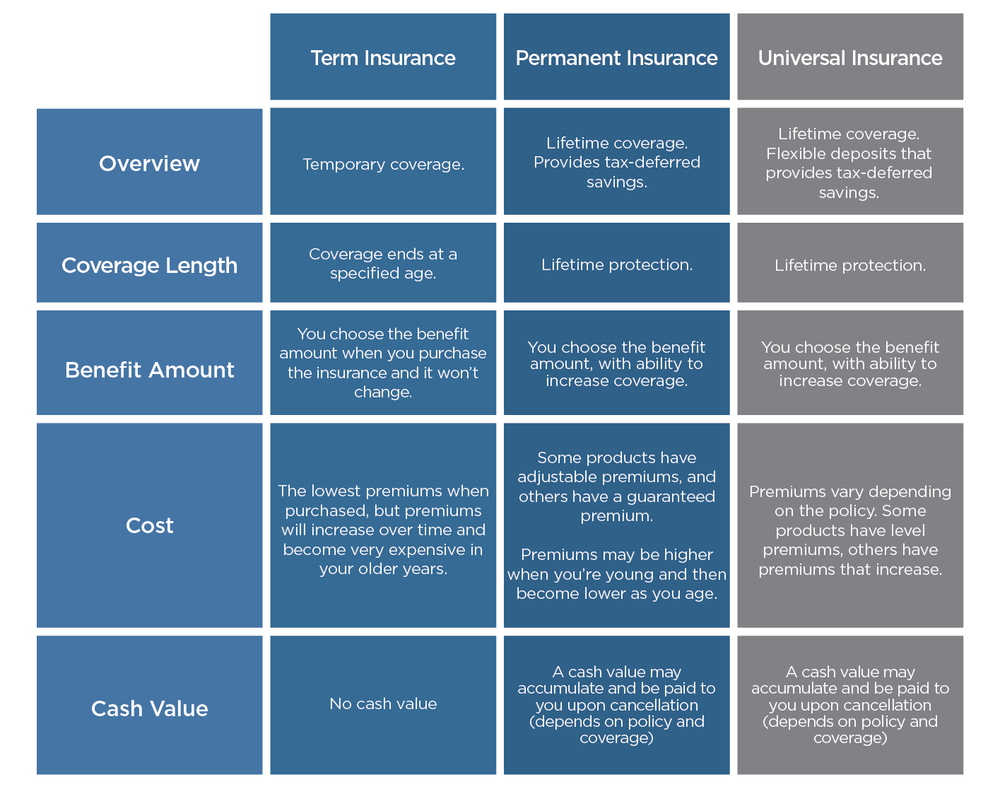

Permanent life insurance policies provide death benefit coverage plus a cash value component that can allow the policyholder to build up a substantial amount of tax deferred savings over time. There can be several attractive universal life insurance tax benefits. Yes there is a tax benefit on life insurance premium paid.

Life insurance policies transfer wealth to beneficiaries through the death benefits paid out when an insured dies. Tax saving life insurance solutions plans. Some such as universal life ul pay a fixed interest rate on the cash within.

Life insurance policies are useful tax planning tools because the policy holder is eligible for tax benefits under the income tax act 1961. 150000 irrespective of the gross total income subject to fulfillment of certain conditions. A keyman policy will remain keyman policy even after assignment of the policy.

Any sum received from life insurance policy as maturity proceeds death benefits is tax free subject to fulfillment of the conditions mentioned therein. Federal transfer tax benefits. Life insurance solves other tax problems asset allocation there are several versions of permanent life insurance.

How To Maximize Your Tax Benefits On Your Life Insurance Policy 5

Life Insurance Corporation Of India Tax Benefit

Infographic How Your Family Can Help You Save Tax Icici Pru Life Blog

Types Of Life Insurance Chessman Wealth Dallas Texas Financial

0 Comments