Lets say you own a 1 year old standard hatchback with insured declared value idv of rs. Confused by the new health insurance laws.

Why Is Car Insurance Mandatory But Not Health Insurance

Buy or renew car insurance policy online.

Why is car insurance mandatory but not health. Car insurance is a type of insurance policy that efficiently takes care of expenses arising from unfortunate events such as an accident theft and any third party liability. Our offerings comprehensive damage cover. Avail discount basis your car make model.

Buy motor insurance or renew your existing car insurance online with us. Get instant car insurance quote comprehensive third party cover for any car. As you go down the list you will notice that driving without insurance is illegal in almost every state so if you own a car you need to make sure you have met the minimum state insurance requirements to drive legally.

With a constant increase in the number of cars on the road it gets very tough to protect your car from unwanted mishaps. You can avail four wheeler insurance to obtain cover for you insured party your car insured vehicle and. Hdfc ergo offers comprehensive motor insurance policy for all round protection and security against all the possible damages against both external and internal factors.

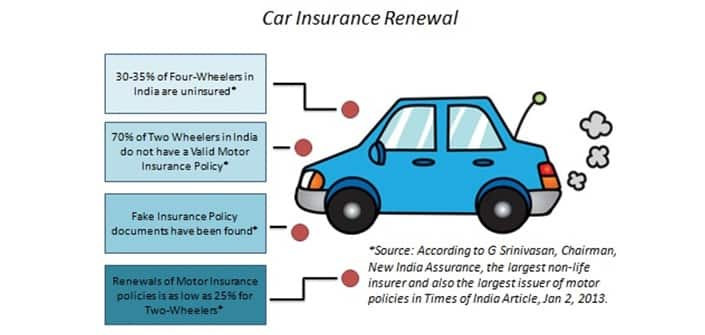

You may already be aware that third party liability car insurance is mandatory by law. As per the motor vehicles act 1988 motor car insurance is mandatory in india. It is also known as auto or motor insurance.

Therefore if you own a car you are mandated by law to take up a third party liability cover. 400000 but sadly dont have car insurancefollowing are the approximate expenses that you might incur if your car was to meet with an accident of medium impact. Why bajaj allianz car insurance.

Car insurance is the smartest way to financially secure yourself and your car. Find out why youll need to buy a health insurance policy if you dont have coverage already. Car insurance is a vehicle policy to protect yourself from financial losses arising from unforeseen risks such as accidents thefts or third party liabilities.

A third party risk policy is a mandatory insurance policy that covers the vehicle owners against risks as per section 146 of motor vehicles act 1988.

Traffic Collision Wikipedia

Car Insurance Compare Renew Car Insurance Policies In India 13

10 Must Knows Of Car Insurance Renewals

Frequently Asked Questions After An Auto Accident Infographic

0 Comments