A term return of premium policy is a term insurance plan that refunds the premium paid for the cover in case the insured party survives the policy period. A term plan is the most basic form of life insurance.

What Are The Data Points In Term Insurance Calculation Dilzer Net

In case of untimely death of the life insured during the policy term the nominee of the life insured gets the total payoutbenefit.

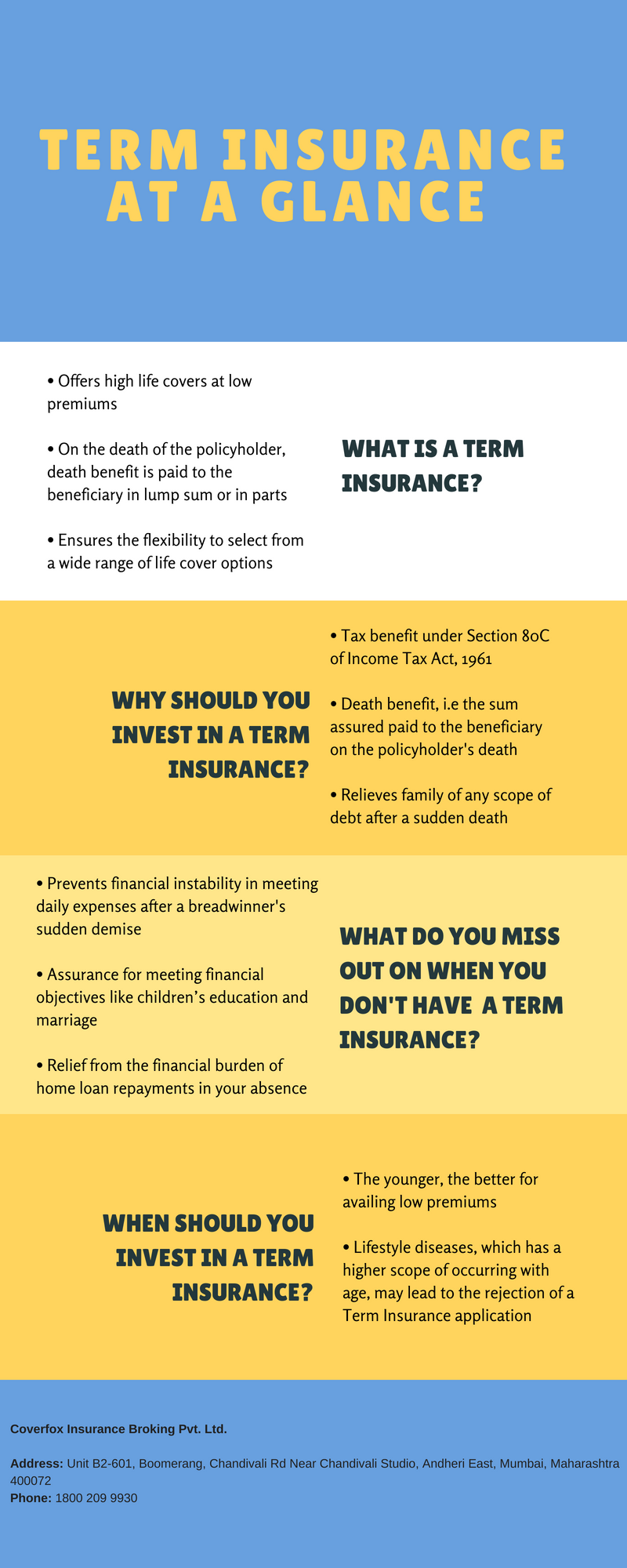

What is term insurance. What is term life insurance. Term life insurance also known as pure life insurance is life insurance that guarantees payment of a death benefit during a specified term. Lets say you have a house with a 30 year mortgage a 48 month auto loan and a college fund youll start using in 10 years.

The percentage saving computed is purely in terms of premium paid over limited term of 5 years difference between limited and regular pay of the policy and does not account for time other factors that may happen during this period. During this term your payments and coverage remain the same. Term life insurance is coverage that lasts for a limited amount of time typically 10 15 20 25 or 30 years.

Standard term insurance is the most simple and straightforward term plan. The life assured pays the premium as per the mode decided at the time of policy purchase. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions.

Term insurance is the purest form of insurance. You have a growing family and the financial obligations that come with it. The policy will be in force for a particular term say 30 years or up to the age of 75 and then comes to an end.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. Once the term expires the policyholder can either. Term life insurance provides coverage for a fixed period of time at a fixed premium rate.

It offers a high cover amount at a nominal premium that is you as the insured or life assured pay a small amount as premium for a certain period or tenure and in case something unfortunate occurs your family or nominee is given a large lump sum amount called the sum assured or cover so there is no compromise on lifestyle.

Term Insurance All You Need To Know About Term Plan At Addsup

Know The Importance Of Term Insurance In Today S Life

What Is Term Insurance Policy And Types Of Term Insurance

What Is Term Life Insurance And Why Doctors Need It Financial

0 Comments