Page 1 of 3 taxation at maturity. The policyholder can use the cash value for many purposes such as a source of loans.

Cash Emergency Tap Life Insurance Policy Instead Creditcards Com

This is one of the most frequent questions we get at ovid.

What is life insurance policy cash value. Having a lifetime of financial protection. Like term life insurance your beneficiary will be paid out the value of the plan in the event of your death. 2008 the madison group inc.

However theres an added investment aspect. Whole life insurance or whole of life assurance in the commonwealth of nations sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in force for the insureds entire lifetime provided required premiums are paid or to the maturity date. This death benefits payment forms one of the bases for calculating the policys cash value.

Cash value life insurance is a form of permanent life insurance that features a cash value savings component. The purpose of a life insurance policy is to provide the policy holders beneficiary with the policys value upon the policy holders death. With whole life insurance you are guaranteed coverage from the day you buy the policy through the rest of your life as long as the premiums are paid which adds up to greater peace of mind.

Older cash value life insurance policies are typically set to mature at a specified age generally age 95 or 100. As a life insurance policy it represents a contract between the insured and insurer that as long. This is a no exam whole life insurance policy that has all the typical guarantees of whole life including a guaranteed death benefit guaranteed fixed premiums and guaranteed cash value growth.

Cash value life insurance is a blended savings and insurance plan. Thats certainly the goal when deciding to buy whole life insurance. Cash value has a nice ring to it when youre thinking about buying life insurance but youll need to do some careful analysis to learn whether a cash value policy is worth the cost.

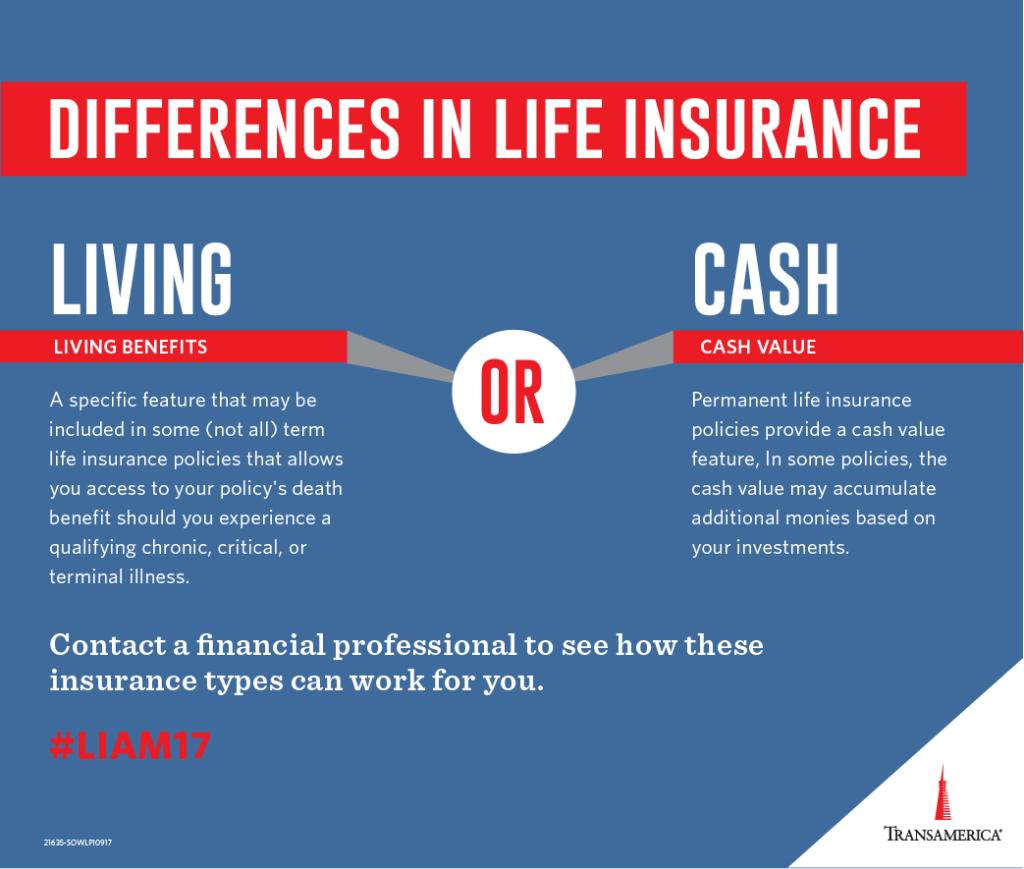

Cash value life insurance is your clients life insurance at risk of creating additional taxation. Here well take some time to answer the question and give you the information you need to decide whether youd like to learn more about selling your life insurance policy for cash. In 2018 american national introduced its signature whole life insurance policy which offers a guaranteed lifetime death benefit and at no additional cost a living benefits rider.

What The Experts Don T Know About Bank On Yourself Part 2 Bank On

Transamerica On Twitter Two Options To Consider When Choosing Your

Whole Life Insurance Thrivent Financial

How To Choose Between Whole Life And Universal Life Insurance

0 Comments