In insurance the insurance policy is a contract generally a standard form contract. That is group insurance contracts are written to comply with state insurance laws and not to satisfy the requirements of erisa or provide legal protection to the plan sponsor.

Ten Favorite Things About Captive Insurance Companies Forbes 1

It 1 puts an indemnity cover into effect 2 serves as a legal evidence of the insurance agreement 3 sets out the exact.

What is an insurance carrier document. It is the company to which your insurance payments are sent and the company that pays if you file a covered claim. Because group insurance contracts are written to cover the legal needs of the insurance carrier. Definition of insurance policy.

The insurance endorsement is the new document that you receive after making a policy change it forms part of your insurance agreement and you should always keep a copy of it with your original policy documents. Insurance is a means of protection from financial loss. When multiple coverage forms are packaged into a single policy the declarations.

A certificate of insurance is a simple document issued by your insurance company that verifies that you have insurance coverage for your small business what that coverage is who it covers the effective date of the policy and the types and dollar amount of limits and deductibles. What is the difference between an insurance agency and an insurance carrier. Formal contract document issued by an insurance company to an insured.

An entity which provides insurance is known as an insurer insurance company insurance carrier or underwritera person or entity who buys insurance is known as an insured or as a policyholder. An insurance carrier is not the same as an insurance agent. After an insurance claim is processed by the insurance carrier paid suspended rejected or denied a document known as aan is sent to the patient and to the provider of professional medical services.

It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. April 18 2014 by jessie mackie an insurance agency sometimes called an insurance brokerage or independent agency solicits writes and binds policies through many different insurance companies. The definitions insuring agreement exclusions and conditions are typically combined into a single integrated document called a policy form coverage form or coverage part.

It is the company to which your insurance payments are sent and the company that pays if you file a covered claim. Faqs about health insurance updated july 12 2018 for administrators and employees a certificate of creditable coverage cocc is a document provided by your previous insurance carrier that proves that your insurance has ended.

Reasons For Life Insurance Claim Denials Or Delays Life Insurance

M Balbil 1 Doc To Indiana Workers Compensation Insurance

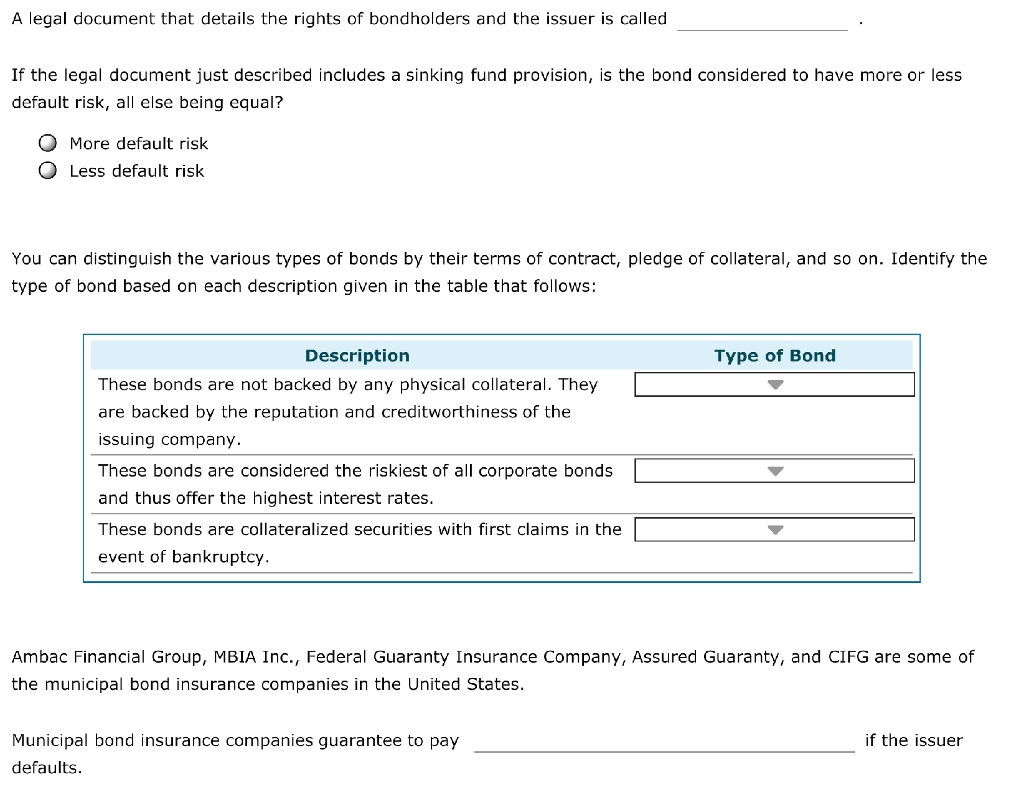

Solved A Legal Document That Details The Rights Of Bondho

Extracting Insurance Companies Practice Management User Manual

0 Comments