The main reason to buy life insurance is to provide a payout to your beneficiaries after your death. Life insurance proceeds arent taxable most of the time.

When Life Insurance Proceeds Are Taxable

Even though the payout of a life insurance policy wont be hit with income tax if the money gained from your policy pushes you over the estate tax threshold which was placed at 549 million in 2017 any money in your estate above that threshold will get hit with the estate tax upon your death.

How is life insurance taxed at death. Beneficiaries will not have to. See topic 403 for more information about interest. While life insurance death benefits are generally excluded from income tax to the beneficiary they are included as part of the estate of the deceased if the deceased was the owner of the policy.

However any interest you receive is taxable and you should report it as interest received. Life insurance proceeds are typically not taxable as income but there are several cases in which a life insurance death benefit or policy benefits would be taxed. Life insurance policies that have the ability to earn cash values such as universal and whole life insurance have the potential of being taxed.

However in order for a tax occurrence to happen the cash value has to be greater than all of the money that has been paid into the life insurance policy. Life insurance death proceeds are generally not taxable income to the beneficiary but there may still be life insurance tax implications depending on how the benefits are paid out and the. Beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have.

Do beneficiaries pay taxes on life insurance. Learn whether youll have to pay taxes on life insurance. First if the death benefit is paid to the estate of the insured then the whole amount of the death benefit is included in the estate and subject to estate tax.

Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. The death benefits paid on life insurance policies are subject to estate tax in two situations.

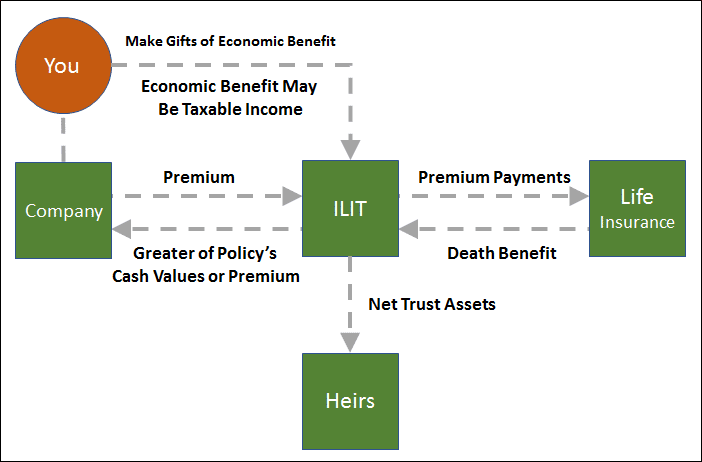

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

Tax Free Retirement Heron Financial Partners Inc

:max_bytes(150000):strip_icc()/179242090-5bfc392646e0fb00265fa90b.jpg)

How To Avoid Taxation On Life Insurance Proceeds

Bank Owned Life Insurance A Primer For Community Banks

0 Comments