Change is a constant in the insurance industry and cblife has been evolving in its own right. It is affordable insurance that one can buy easily without any hassles.

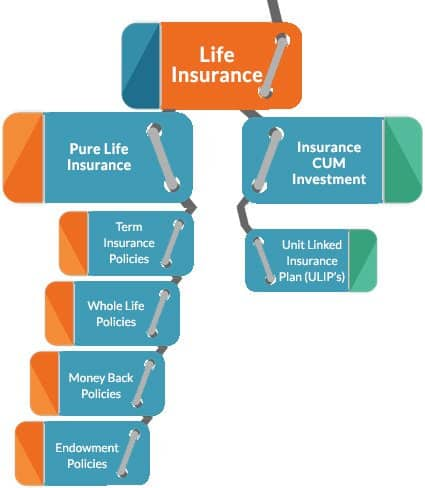

Life Insurance Compare Best Life Insurance Plans Online In India 2019

For 2018 you cant claim a personal exemption deduction for yourself your spouse or your.

Can one person claim two life insurance. Here are the details of aforementioned plans. We have direct payment agreements with hospitals ensuring you can just focus on getting better. We pay all hospitals directly.

Term insurance is the most basic form of life insurance. Information technology risk or it risk it related risk is a risk related to information technologythis relatively new term was developed as a result of an increasing awareness that information security is simply one facet of a multitude of risks that are relevant to it and the real world processes it supports. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss.

In some cases the amount of income you can receive before you must file a tax return has increased. Insurance is a means of protection from financial loss. In 2015 cblife joined global bankers insurance group an international family of insurance and reinsurance companies focused on retirement annuities and life insurance.

You must call customer service at 1 972 540 6542 to start the claims process. The surviving partner will no longer have a life insurance policy but will have the option to take out a new single life policy. The importance of life insurance.

Life insurance is one of the most important decisions you can make to give you and your loved ones financial security and peace of mind. With vhi healthcare you wont have to settle the bills yourself before making a claim. A joint policy covers two people in a relationship.

Globe life insurance claim. Table 1 shows the filing requirements for most taxpayers. Filing the claim with globe life insurance provider.

Two wheeler insurance refers to an insurance policy taken to cover against any damages that may occur to a motor cycle andor its riders due to an unforeseen and unforeseen event like an accident theft or natural disaster. An entity which provides insurance is known as an insurer insurance company insurance carrier or underwritera person or entity who buys insurance is known as an insured or as a policyholder. A tax free lump sum is paid when the first policyholder dies during the term.

Make A Life Insurance Claim Aviva

Life Insurance Compare Best Life Insurance Plans Online In India 2019

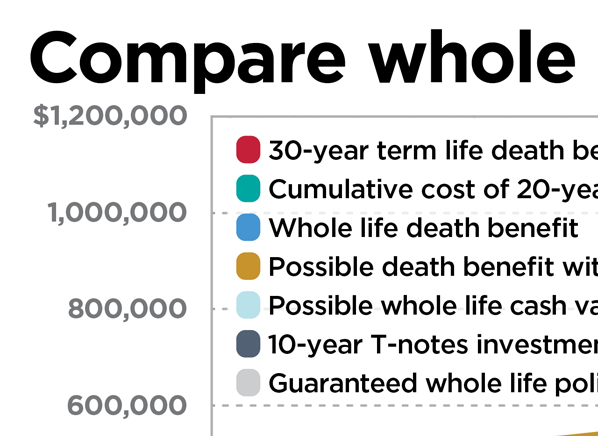

Is Whole Life Insurance Right For You Consumer Reports

Life Insurance Compare Best Life Insurance Plans Policies

0 Comments