Life insurance companies do not have restrictions when it comes to buying multiple policiesas long as the coverage amounts are justified. Purchasing multiple life insurance policies with different amounts and term lengths is a great strategy known as laddering.

Term Insurance Compare Online Term Plans Policy

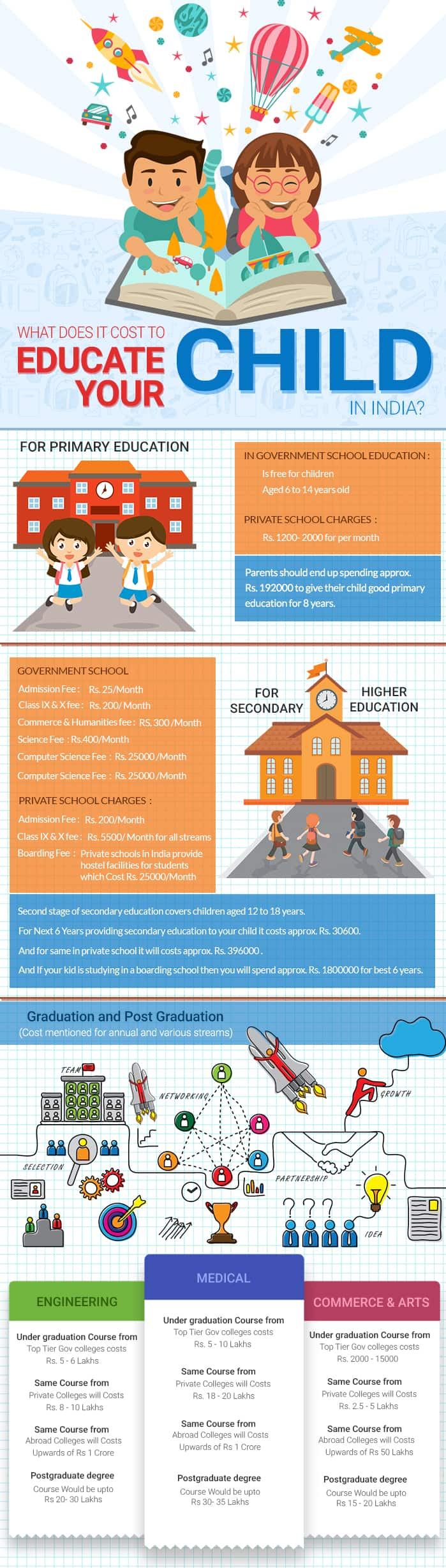

These plans offer a lump sum amount at maturitywhich can be used for different needs of the child ranging from higher education expenses to expenditure on marriage.

Can i have a child policy with different insurance companies. Child life insurance could pay out if your child dies or is diagnosed with a serious illness or condition during the term of a policy. I am looking into doing some infertility treatments that are not covered under my insurance company due to me working for a catholic. It might be possible for there to be two car insurance policies in one household depending on the insurance companies involved and the circumstances.

Some companies will not allow it because of state laws and liability exposure. Keep in mind that you need to be living with the person who is on the insurance policy. This is a list of insurance companies based in the united statesthese are companies with a strong national or regional presence having insurance as their primary business.

We all know how expensive that is especially for a teenagenew driver. Can drivers of the same car have different insurance companiespolicies. Two car insurance policies can be held in the same household in certain situations.

Different insurance companies have different names for policies that are shared by individuals who are not married to each other. All insurance companies charge more for drivers under 25 because they are considered high risk drivers. During the policy tenure insurance companies often.

Can a person have more than one health policy. The worst case scenario is adding your child to your policy after they have received several traffic violations. A few insurance companies have started policies called engaged couple policies.

That is not a hard and fast rule however because you can often continue to insure your child when he goes off to college or even after she moves away as long as the child will be driving a vehicle owned by you at some point in time. You can have multiple policies from different insurance carriers. Funds for the out of pocket costs for yourself and all your qualifying dependents even though they are covered under a different insurance plan.

You will want to check with your auto insurance company to see how this will affect your rates. I just got my license in december and im driving my moms car but i need car insurance under my name. Generally speaking you can insure your child on your car insurance policy as long as he or she lives at home with you.

Child plans offered by insurance companies are investment policies that help take care of the future needs of a child. You can add cover for your children with any of the life insurance policies in this comparison and get critical illness cover for them too.

Should You Look Outside The Aca S Exchanges Healthinsurance Org

Keep These In Mind When Getting Insurance

Health Insurance Compare Best Medical Insurance Plans 12 Feb 2019

Child Plans Best Child Education Plan Life Insurance India

0 Comments